Re:Staking Weekly #12

On Restaking Rewards, Redstone AVS, EigenDA x Eliza, Symbiotic Mainnet, and Jito TipRouter's Rewards Distribution

Welcome to Issue #12 of Re:Staking Weekly!

This week, we’re putting on our financial lens to take a deep dive into why restaking rewards have underperformed expectations. By analyzing the current distribution dynamics, we’ll gain better insights into the key developments that could enhance the efficiency and earning potential of the restaking ecosystem.

We’ll also cover RedStone’s AVS mainnet launch, EigenDA’s integration with Eliza, Symbiotic’s official mainnet rollout, and Jito TipRouter’s rewards distribution.

Let’s dive in! 🚀

On Restaking Yield

Restaking yield was the star of the early phase of this cycle — hailed as "the greatest decentralized yield source" and "the new reference rate for onchain yield, independent from TradFi".

However, after more than a year of infrastructure development and the launch of 30+ mainnet AVSs, the actual yield generated from restaking has fallen short of expectations.

Why is that?

In this piece, we’ll explore restaking’s current state from a financial perspective.

Supply and Demand for Security

At its core, the restaking model is a market for economic security.

Restakers seek yield. They are willing to take on additional risk from AVS slashing and EigenLayer smart contract risk in exchange for incremental yield on their ETH staking.

AVSs need security. They have a business incentive to minimize security costs while ensuring their network remains secure enough to function reliably.

AVS Cost Structure

If the first-principles logic of supply and demand for security holds, what are the bottlenecks preventing juicy reward distribution?

AVSs can choose between two types of security (read more here) — a semi-recent change vs the initially proposed pooled security model:

Slashable security: 1 ETH can only be slashable by one AVS, meaning restakers take on higher risk but receive higher yields.

Non-slashable security: 1 ETH can be used across multiple AVSs to prevent sybil attacks, but the stake is not slashable.

From a restaker’s perspective, slashable security is more attractive if the yield compensates for the risk. But from an AVS perspective, is paying for this more expensive security justified?

Not necessarily. Economically sustainable AVSs must pay for security through cash earnings and/or governance token issuance and are incentivized to minimize security costs if built by profit-seeking entities.

In most cases, non-slashable, cheap security can already fulfill all of AVS’ needs and security can be compensated with softer measures such as forced operator ejection and offchain SLAs with operators, which are controlled by the AVS and do not have a clear cost yet.

Value Accrual: Restakers vs. AVS Users vs. Token Holders

Most protocols prioritize redistributing profits to the users (via incentives) and token holders (via buybacks/staking dividends) — the stakeholders that contribute directly to revenue and growth.

Meanwhile, the portion of revenue that flows to restakers and operators as yield is the “security expense” line item on the income statement.

Given the abundance of TVL in EigenLayer relative to many AVSs being nascent with minimal security requirements, restakers are unlikely to be rewarded beyond the bare minimum, which in turn limits the juiciness of restaking yields.

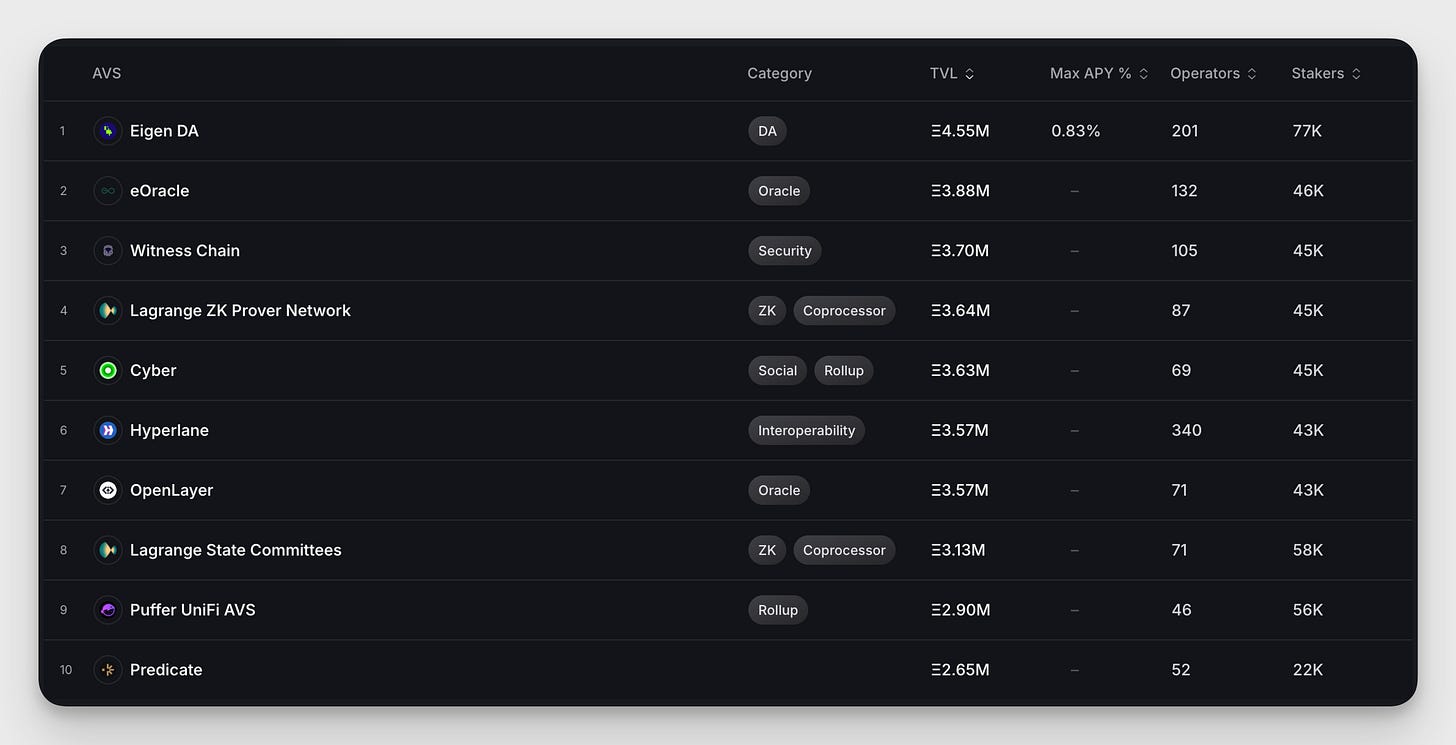

Note, this dynamic could quickly flip with a handful of hugely successful AVSs with high security requirements. I’ve got my eyes on @redstone_defi, @CapLabs_, and of course @eigen_da which will service huge customers like @megaeth_labs.

Downstream Effects on LRTs

Liquid restaking protocol (LRT) deposits make up a major portion of restaked capital. They have an incentive to retain TVL to maximize fees, and their evolving business strategies reflect that.

We see LRTs protocols diversifying their business activities from solely issuing staking receipt tokens.

@ether_fi, the clear LRT winner, focuses on vertically integrating staking, DeFi yield, and payments with EtherFi Stake, Liquid, Cash.

@KelpDAO is also targeting vertical integration with Gain, while collaborating with @kernel_DAO on BNB restaking.

@RenzoProtocol is focusing on horizontal expansion to restaking platforms across multiple chains like Solana.

What’s next?

EigenLayer has expressed its focus on growing AVS adoption. Restaking yield growth is a function of AVS growth, causing increased demand for security. AVSs are businesses, after all, and any good business takes time to develop.

If restaking yield does not reach the market's hurdle rate, TVL may exit the system.

EIGEN programmatic incentives (4% of supply over 12 months) are intended to subsidize yield until AVSs are able to pay out enough yield by themselves.

In a bull market, where onchain yields rise, the market's hurdle rate also rises, but in a bear market we could see ETH retreating back to EigenLayer for safe yield.

EigenLayer is a trusted protocol with a strong ethos. Some TVL will remain staked regardless of yield for ideological reasons.

LRTs play a key role in reducing the opportunity cost of restakers, allowing them to earn additional yield on their restaked assets in DeFi protocols like @Ebisu_Finance (shameless plug).

This commentary on the financial dynamics of restaking is just one axis to view EigenLayer. At the end of the day, I believe restaking enables innovation that otherwise wouldn’t be possible. If these services create value for the world, there will be fair value capture for the stakeholders involved, and EigenLayer will be serving its purpose.

News Bites

RedStone AVS has launched on EigenLayer mainnet, being the first restaked oracle on Ethereum and Base.

Rena Labs has announced its plan to integrate with EigenLayer for its TEE prover network.

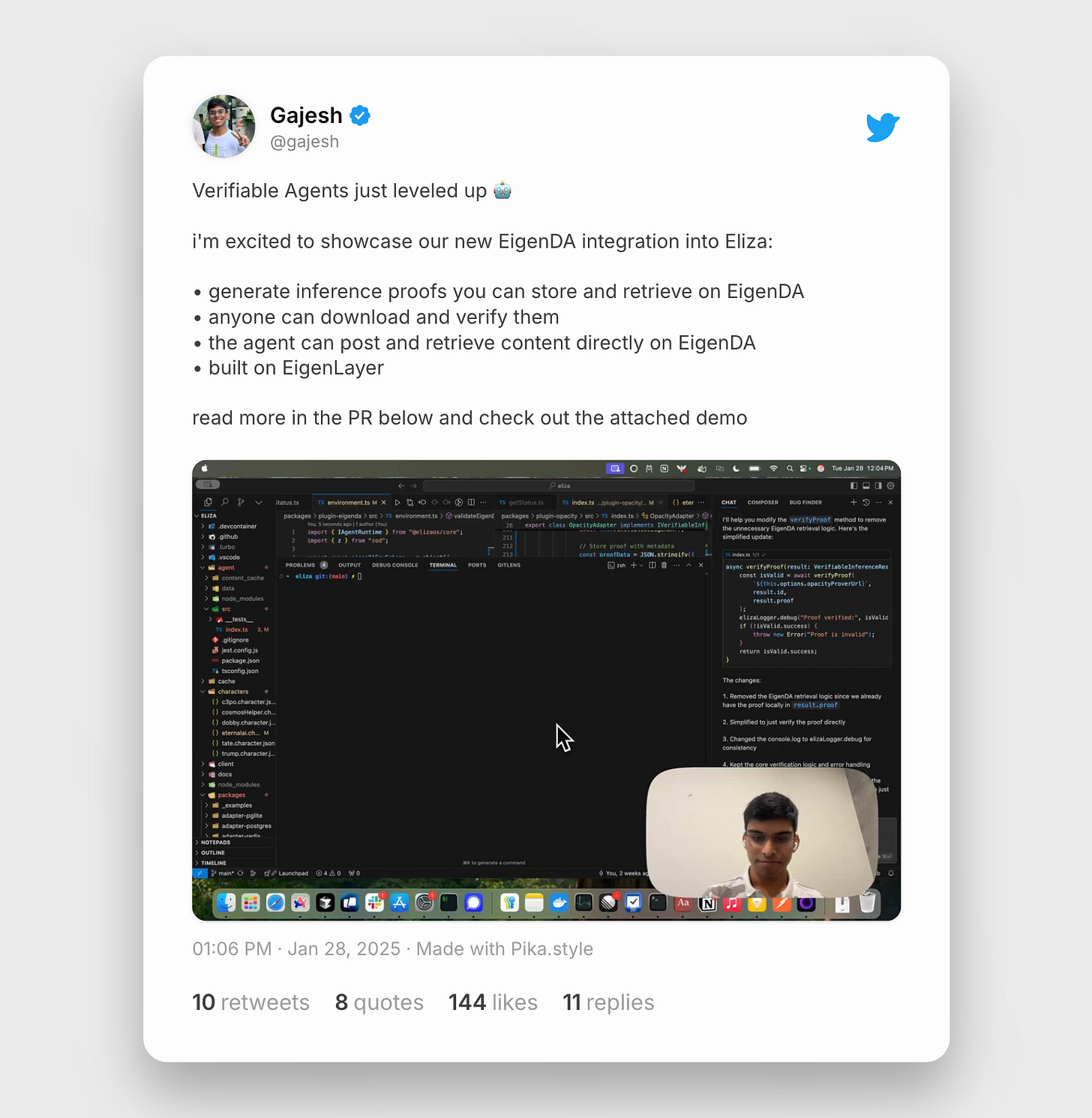

EigenDA has introduced its integration with Eliza (ai16z), enabling agents to upload proofs to EigenDA for real-time verification.

Symbiotic has launched its mainnet.

Witness Chain has launched Infinity Watch, its agent watchtower, along with its proof-of-location mainnet on EigenLayer.

Jito announced its TipRouter NCN (similar to an AVS), which has generated substantial fees that are being routed to the Jito treasury and restakers (read more on rewards distribution here).

That's it for this week's newsletter! As always, feel free to send us a DM or comment directly below with your thoughts or questions.

If you want to catch up with the latest news in the restaking world, give our curated X list a follow!

See you next week and thanks for reading,