Re:Staking Weekly #15

Slashed Asset Redistribution, EigenLayer’s AVS Renaming, UMA’s Restaking Integration Plan, and 55% APY for Jito Restaking

Welcome to Issue #15 of Re:Staking Weekly! 👋

This week, we begin with an analysis of the potential slashed-asset redistribution feature that anyone can implement for restaking. Will it benefit everyone, or will it disrupt the restaking market equilibrium and security?

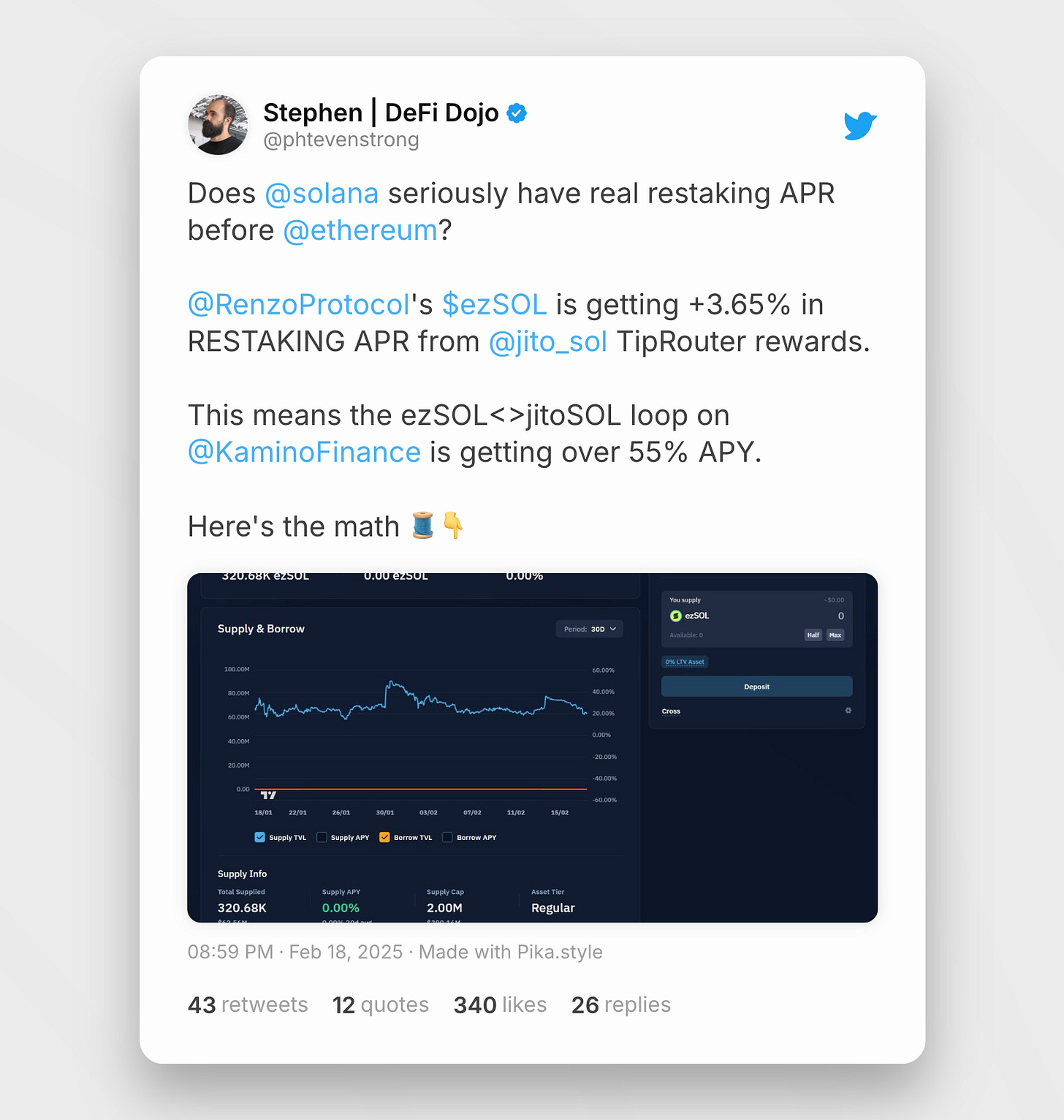

Also featured this week: EigenLayer’s big AVS renaming announcement (spoiler: it’s still called AVS but with a twist), Lido V3’s early adopter program (for those holding stETH), a strategy boasting 55% APY on Jito Restaking, UMA’s plan to integrate restaking into their oracle for stronger incentives, and much more.

Let's dive in! 🚀

Should Slashed Assets Be Redistributed?

Redistributing slashed assets could change how we think about penalties in the restaking ecosystem. Could this feature represent a new way to protect restaker interests while maintaining a sufficient level of economic security?

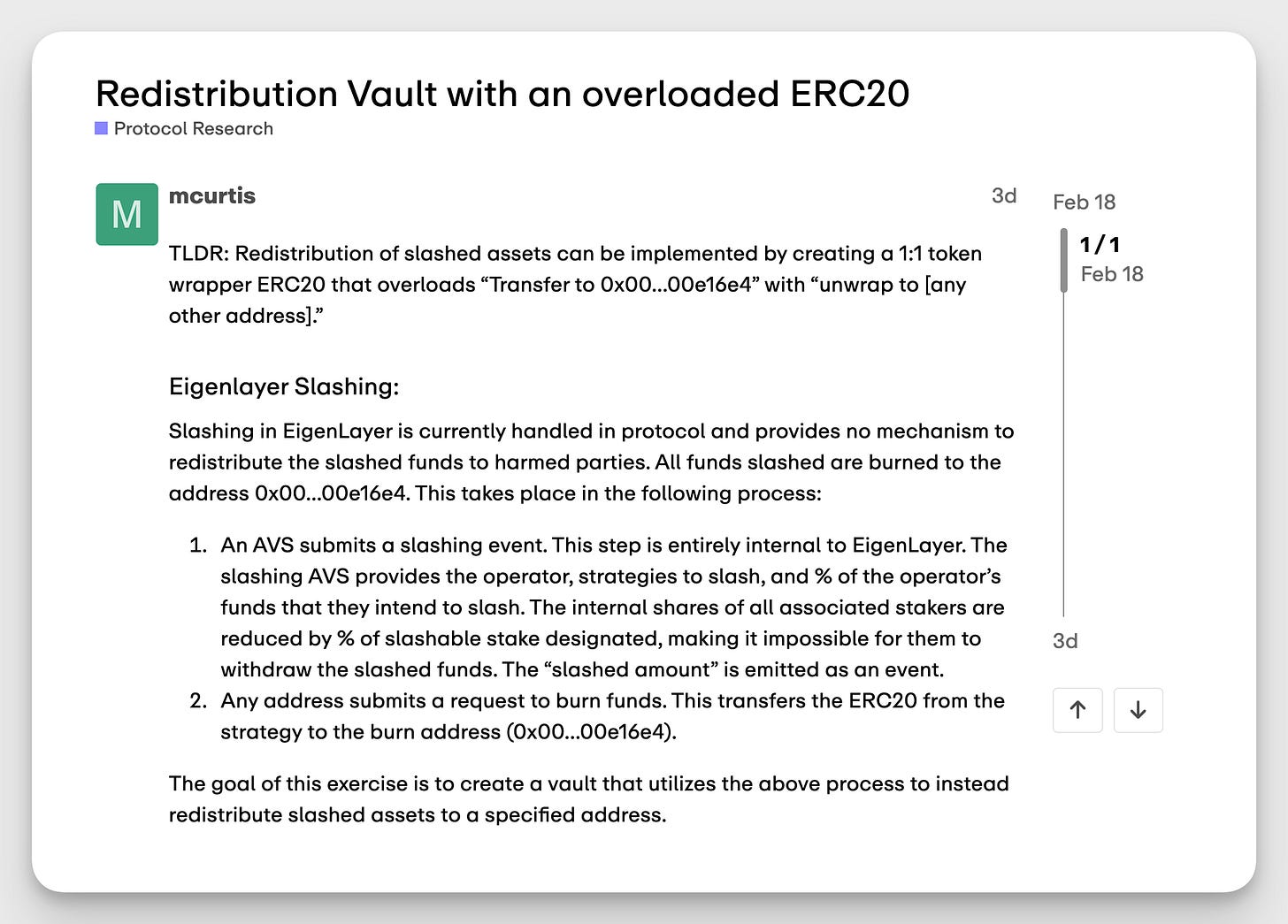

This week, new research was published on the EigenLayer forum outlining a mechanism that could be implemented alongside EigenLayer's core architecture. It would redistribute the slashed assets from a faulty operator to other healthy operators, thereby retaining asset security.

Tell me more about the slashed asset redistribution

The existing slashing design operates on a straightforward principle: when a slashing event occurs, staked assets are burned completely. This creates a real economic penalty for both the operator at fault and the restakers who chose that operator.

Under the proposed redistribution design, instead of burning slashed assets, they would be redistributed to other operators in the set. Under this system:

Only operators face penalties.

Restakers' assets transfer to other operators rather than getting burned.

The network's total economic security remains intact.

One note is that this mechanism can be implemented by anyone. It is essentially a wrapper on top of the existing restaking strategy that has redistribution logic built into it. The wrapper token gets restaked and slashed, while the original asset remains intact. Therefore, it is highly likely this feature would be built by ecosystem participants first rather than by EigenLayer itself.

Who would benefit from redistribution?

Restakers appear to gain the most. By redistributing slashed assets rather than burning them, restakers would not face direct penalties — making restaking feel like a “free lunch.” Their only real cost is the potential opportunity cost of missing out on higher yields elsewhere, but their principal remains protected regardless of slashing events. (Note: Although a single restaker might benefit from never needing to worry about losing the asset, the restaker group’s overall interest could be harmed, as their stake is now less valuable.)

LRTs also stand to benefit. Since LRTs can spread stake across multiple operators, when one operator is slashed, part of the penalized funds would be redistributed to the remaining, healthy operators. This design also reduces liquidation risk on lending platforms because the underlying assets stay intact.

Finally, AVSs could benefit by maintaining a stable level of nominal economic security regardless of slashing incidents. If restakers see no downside to staking, AVSs may attract more participants and increase overall security.

It sounds like everyone benefits… What’s the catch?

Despite the upside, some AVSs might worry about the bad incentives redistribution creates. If operators who aren't slashed automatically receive the slashed assets, they might be tempted to team up and slash competitors just to grab those extra funds.

Ecosystem-wise, the skew in incentives could undermine overall trust and prevent it from reaching a sustainable equilibrium and adoption. Specifically:

If economic security (TVL) is primarily used as a Sybil resistance mechanism, the sheer volume of capital might drive down returns, making this added complexity less appealing.

In certain non-dPOS systems, there may also be a strict requirement to slash the actual staked asset, rendering redistribution strategies incompatible.

Lastly, excessive customization can confuse users and reduce overall adoption, as the costs of understanding novel security models can be significant.

How would redistribution impact the overall security of the restaking ecosystem?

In short, it’s too early to tell.

Currently, the adoption of slashing on testnet (which is a really bad metric) is precisely 0, and to even consider something like redistribution, we would need some slashing adoption on testnet or mainnet, the redistribution token wrapper accepted by slashing-enabled AVS, and then we can empirically assess the effect on the broader ecosystem.

It is similar to all other slashing-related features — such as operator ejection, freeze, or blacklist — as none have been tested, adopted, or implemented on mainnet yet.

Some worries remain. One of our community members wonders if redistribution creates a high probability of exogenous pressure to trigger slashing events, and whether this is a pathway towards operator collusion.

Finally, this debate raises a fundamental question: in a world where most capital providers aren't directly operating services, who should bear the penalty for attributable faults — the restaker or the operator or both?

Special thanks to our community members for contributing to the discussion: Beryl, Bowen, Brandon, Carson, and David.

News Bites

The ball has dropped. AVS is still AVS, but it now stands for Autonomous Verifiable Services. Read more about the AVS name change here.

Take a look at EigenLayer’s Operator Mainnet Campaign, an interesting source to learn more about institutional and homebrew operators and their competitive advantages.

Lido V3 EA program is now live. In the future, custom vaults can tap into restaking yield sources with stETH as the restaking asset.

UMA is introducing a joint research and integration initiative between Polymarket and EigenLayer (official blog post). This joint effort could potentially enable UMA’s data oracle to accept multiple assets, better aligning with the data feed and end users.

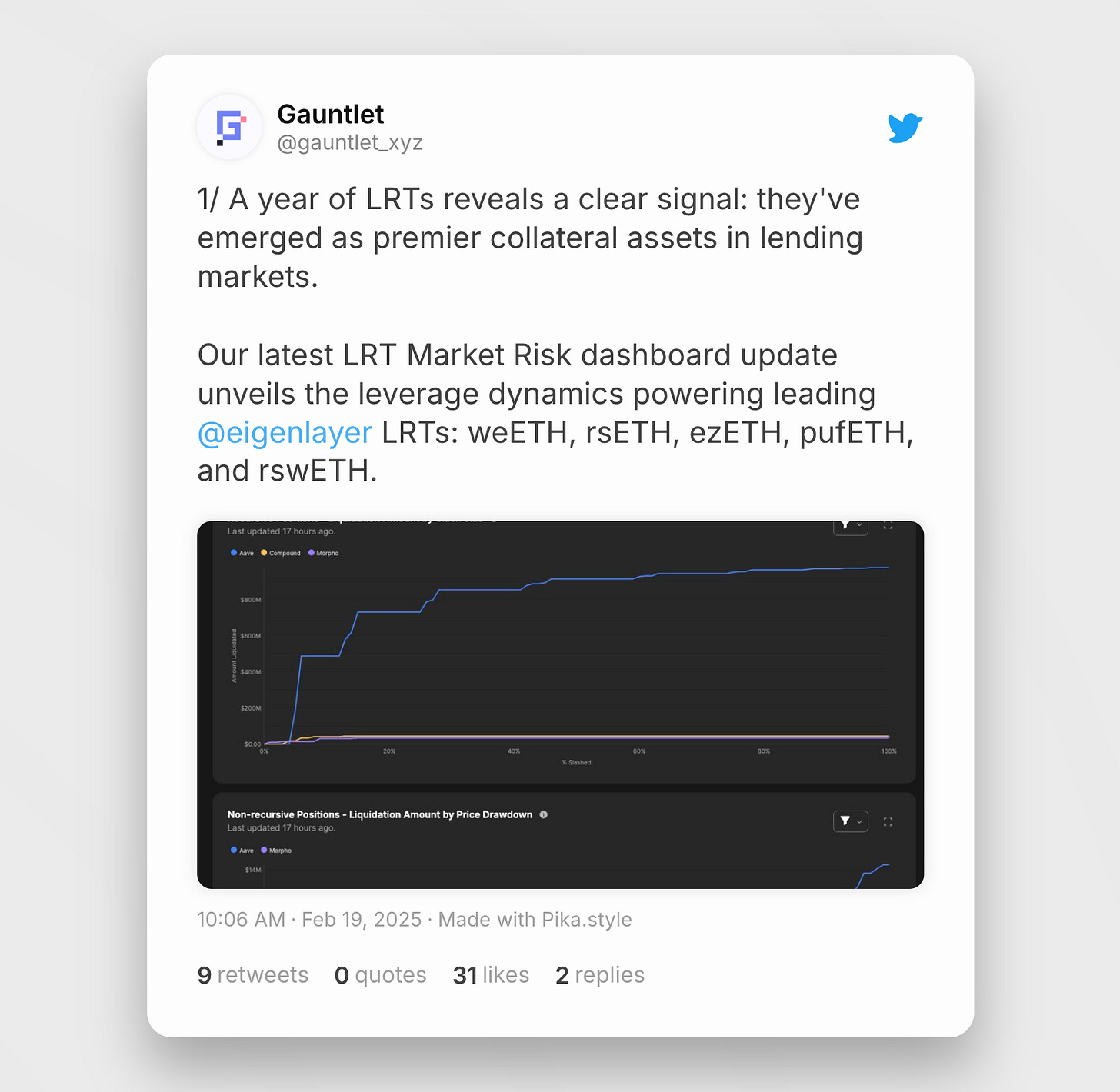

Holding LRTs? Explore Gauntlet’s LRT Market Risk dashboard to assess the health of your position.

Predicate AVS’s compliant bridge is now live on Aleo — a significant milestone in driving Predicate’s adoption.

The restaking APR game is now going multi-chain, and Jito’s TipRouter is leading the way.

Read Finality Capital’s thesis on Opacity AVS.

That's it for this week's newsletter! As always, feel free to send us a DM or comment directly below with your thoughts or questions.

If you want to catch up with the latest news in the restaking world, give our curated X list a follow!

See you next week and thanks for reading,